I recently took some time to appreciate and celebrate the SAS Professional Services division’s 25th anniversary. I find it impressive that SAS professional services has been collaborating with customers across many different industries for 25 years to solve business problems, increase profitability and improve customer service levels.

With so much industry domain knowledge available, I thought it might be useful to create a new blog series that will focus on exploring specific challenges and approaches in the area of demand forecasting.

Forecasting challenges for pharmacy benefit management organizations

Pete Dillman Advisory Analytical Consultant at SAS has penned a preliminary white paper on demand forecasting in the Pharmacy Benefit Management domain. Much of what follows has been extracted from his material and provides a summarized view of forecasting processes, challenges and improvements for pharmacy benefit management (PBM) companies.

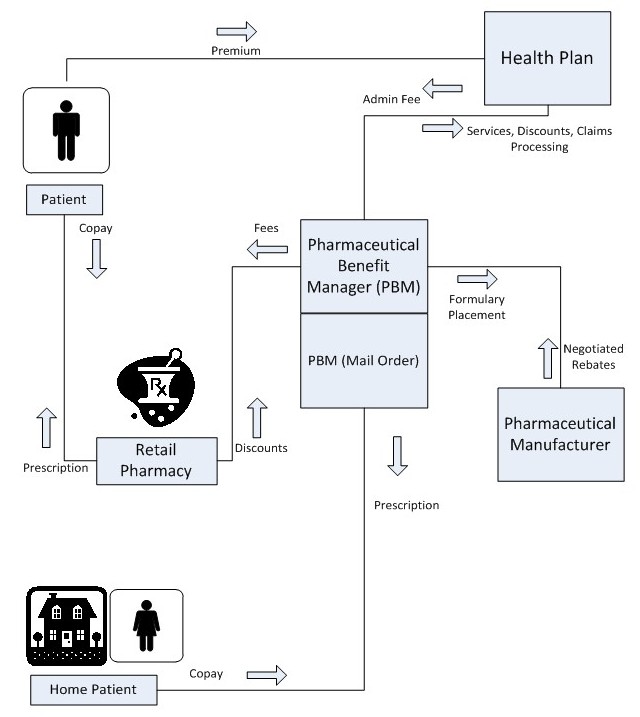

PBMs act as third party drug program administrators for their clients, typically interfacing with health plan insurers, retail pharmacy chains and drug manufacturers. They also specialize in program design and management, formulary development, specialty program management and script fulfillment (especially in mail service claims processing). The image below shows how PBM companies fit in the larger pharmacy ecosystem.

The PBM revenue model is based on leveraging its expanding account base in order to establish mutually favorable pricing and discount policies while helping clients maximize efficiency.

The cornerstone of a successful pricing strategy is an accurate forecast of claims volume combined with a projection of processing expenditures. An accurate forecast is essential to setting fee pricing, average wholesale price discounts and maximum allowable cost rates, in order to balance revenue acquisition with competitive pricing for clients.

Deviations in forecast accuracy can compromise revenue expectations and jeopardize client business through non-competitive pricing and loss of leverage. In many cases, service level agreements tied to expected volumes and processing metrics can be compromised through an inaccurate forecast, thus initiating potential costly penalties.

Forecast processes and challenges

Most revenue or supply chain forecasting is centered on the projection of periodic claims and revenues for each primary client and channel (such as mail-order, electronic, etc…). The top five challenges for claims/revenue forecasting are:

- Forecast models are often heavily dependent on member fluctuation patterns.

- The typical drug “brand-to-generic” life cycle cannot be modeled easily.

- Revenue forecasts are influenced by expected cost and discount strategies that vary by brand and specialty level for each client.

- Many external factors (e.g. macro-economic, epidemiological) can potentially influence the forecast

- Unplanned deviations (e.g. delay in off-patent) can be the source of extreme cases of forecast error.

Forecasting process remediation

The key to improving a forecast process lies in the ability to build an analytical methodology within the framework of the PBM’s business, IT and analytical infrastructure that can serve as a foundation for a more expanded forecasting platform. The five following steps should be considered:

- Conduct a review of inter-departmental marketing and planning strategies for expansion and price optimization for purposes of eventual inclusion into forecast models. This would include a quantification of the specific impact of forecast error on the business.

- Review existing claim data sources for information that could drive lower levels of segmentation

- Explore potential sources of external information as augmentation to the core forecast.

- Allow the forecasting process to incorporate deeper hierarchical levels (e.g. product class, customer segment, etc.) along with appropriate reconciliation techniques that facilitate proper roll-up.

- Formulate alternative forecast scenarios around potential pricing strategies and consider a flexible, multi-step forecast approach (e.g. forecast expected channel migration and using that forecast as an input to the claims forecast).

Value proposition of forecast improvement

The tangible business value of an improved forecasting process to a PBM is centered on these primary areas:

- Profitability: Improved accuracy increases fee/discount negotiation leverage and reduces the likelihood of service level agreement penalties.

- Supply Chain Improvement: Improved accuracy streamlines inventory, optimizes resources and increases customer satisfaction.

- Organizational Efficiency: Forecast Automation enables faster throughput and organizational dissemination of results.

- Business Planning and Growth: Forecast collaboration becomes an integral part of business planning and evaluation through examination of emerging factors, customer behavior, market activity and the influence of global health trends on claims activity.

Pete Dillman is an Advisory Analytical Consultant in the Global Forecasting and Optimization Practice at SAS where he provides end-to-end business and analytical consulting services that build practical forecasting solutions to real-world applications .